The Real Problem with Financial Management

Most approaches focus on the numbers, forgetting we're people with relationships.

- Carrying the mental load alone

- The "money talk" gets delayed again

- Scattered documents and notes

Why Sabal is Different

We help families balance financial and relationship needs.

- Share the load, not all your data

- Routine check-ins that prevent surprises

- Find any document instantly

How Sabal Can Help Me ...

Collaborate as a Couple

Productive financial conversations with less stress, fewer misunderstandings, and better decisions.

Sabal helps couples have productive financial conversations by creating a shared overview for decisions while letting each person deep-dive into what matters to them.

Learn how to collaborate as a couple

The Tools That Make It Work

Get a full financial picture — and share only what you choose with the people who need it.

Key Features

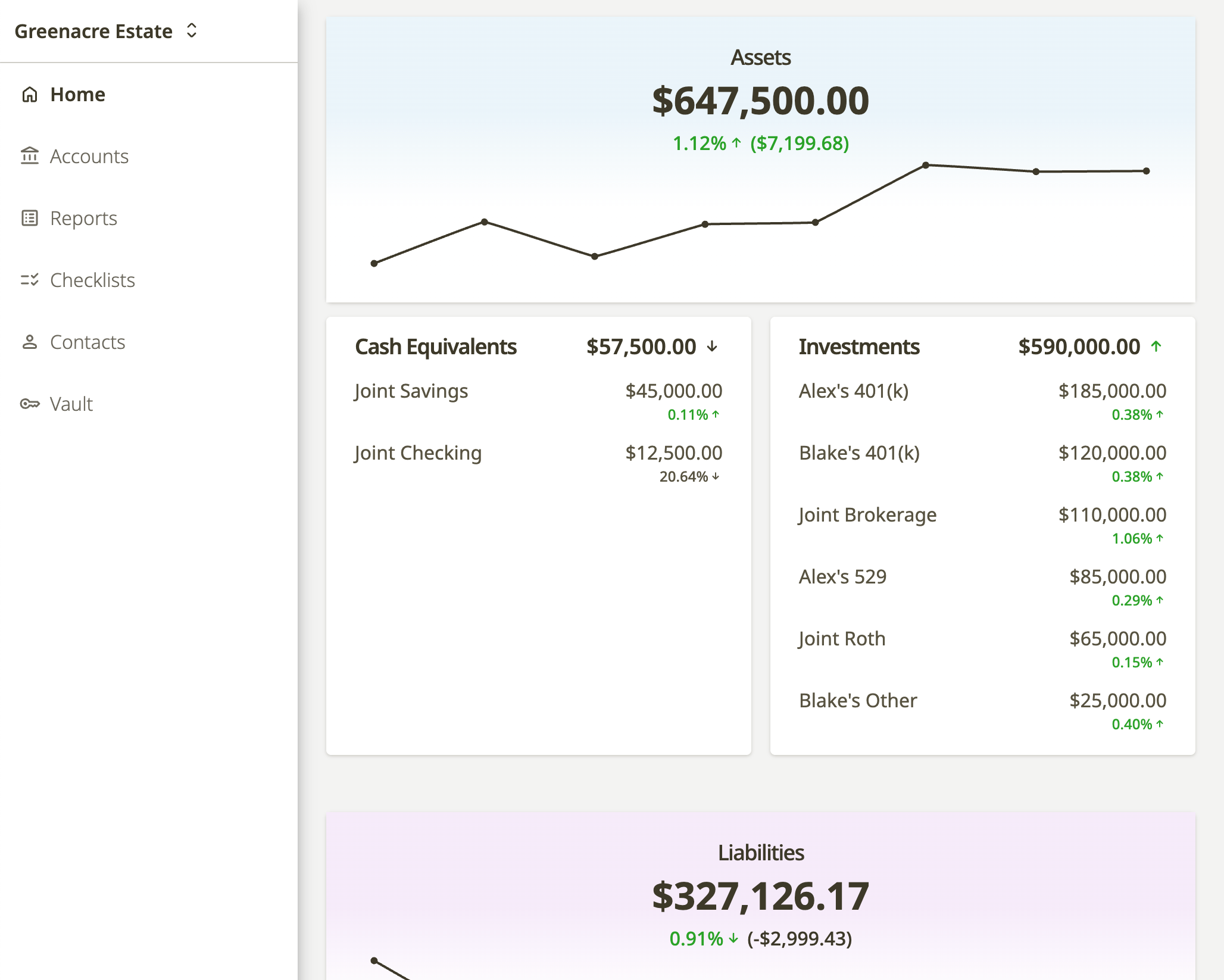

Net Worth Tracking

Track all your assets, liabilities, and investments over time.

Connect to over 12,000 institutions automatically or add accounts manually.

Dual-Key Storage

Securely store wills, medical directives, and financial documents in your workspace's vault.

Each item is encrypted with its own key for layered security.

Smart Checklists

Turn complex tasks into guided checklists that tap into your workspace's data.

Assign steps, track progress, and build momentum together.

Contact Management

Keep your financial contacts organized and accessible.

Share notes and contact information for doctors, lawyers, and financial advisors.

Customized Insights

Turn data into clear, tailored insights for each person.

Track spending, visualize investments, and create custom reports.

Your Family's Information is Safe With Us

We protect your family's sensitive information using the same encryption and security measures used by financial institutions and recommended by government security experts.

- Your data is encrypted

- Multi-factor authentication secures access

- We never sell your information

Ready to Simplify Your Family's Finances?

Early members get a 30-day free trial (no credit card required) and early-access pricing, plus guided onboarding to help you get the most out of Sabal.

You Might Be Wondering…

How does Sabal protect my family's financial information?

How does Sabal protect my family's financial information?

We use multiple layers of protection, including AES-256 encryption for stored data and TLS 1.2+ protocols for data in transit. All workspace access requires two factors of authentication and we use isolated data storage to keep your information private and secure.

Each item stored in your workspace vault (files, notes, passwords) is encrypted with a unique key following a practice called “envelope encryption.” This means that even if someone were to gain access to the stored vault conent, they would not be able to read the data without each encryption key.

Sabal runs a Vulnerability Disclosure Program that defines how security professionals can contact Sabal in the event they find an issue and how Sabal will respond.

Can Sabal move money or change anything in our accounts?

Can Sabal move money or change anything in our accounts?

No. When connecting to your institutions, we receive limited, view-only access to the accounts you choose. Neither Sabal nor our partners can move money or see full account numbers.

Does Sabal store my institution credentials?

Does Sabal store my institution credentials?

No, Sabal never stores your sign-in information for financial institutions.

When you connect an account, we use secure, industry-standard practices to establish a read-only connection. Your credentials are transmitted securely to the institution but are not stored by Sabal or our connection partners. This way, we can provide up-to-date information about your accounts without compromising your security or privacy.

Learn more about how Plaid handes your financial data on their website.

How many accounts or people can we add to our workspace?

How many accounts or people can we add to our workspace?

Don’t worry about limits - Sabal is designed to grow with your family’s needs. Invite as many people and connect as many accounts as you’d like.

How often are account balances and transactions updated?

How often are account balances and transactions updated?

Each institution updates at a different rate, but we’ll process every update we’re provided. Most connected accounts update daily, with some updating four times a day.

Manual accounts are updated as often as you’d like.

Can Sabal help us spot unusual account activity?

Can Sabal help us spot unusual account activity?

Yes. Our Financial Check-In feature highlights important changes and unusual activity, making it easier to catch potential issues quickly.

We do not currently have alerting functionality.

Can people in my workspace see everything? How do I control what they see?

Can people in my workspace see everything? How do I control what they see?

No, not necessarily. Workspace permissions are customizable, giving you full control over what each person can see and do:

- You decide what each workspace member can see and do.

- Permissions can be tailored to balance transparency with privacy, based on each workspace member’s role.

- You can easily add or remove members or adjust their permissions at any time within the app.

Free Tools for Families Managing Money Together

Step-by-step guides and checklists for protecting your finances and supporting the people you care about.

Emergency Fund Strategy for Couples

Plan a shared emergency fund that balances access and after-tax yield using Treasury bills and high-yield savings accounts

- Compare yields between Treasury securities and savings accounts

- Plan liquidity strategy for different timeframes

- Interactive calculator with real-time rates

Credit Freeze Checklist

A comprehensive guide to freezing your credit reports to prevent identity theft

- How to freeze credit at all three bureaus

- Tracking worksheet for freeze confirmations and PINs

- Instructions for temporarily lifting a freeze when needed

Your Parents' Finances: What's Your Role?

Learn how to support your parents' finances based on their needs and comfort level

Have you initiated end-of-life planning conversations with your parents?

Are your parents susceptible to financial fraud or exploitation?

Wealth Words

Everyday definitions for the terms that matter in financial planning

Power of Attorney (POA)

Legal document that authorizes a designated individual to act on another's behalf in financial or legal matters.

Representative Payee

Individual appointed to receive and manage government benefits for someone unable to manage their own funds.

Meet the Founder

I started Sabal after hitting the same wall repeatedly - trying to help family with finances, but existing tools expected us to share everything. Whether planning my parents' retirement or helping a relative after a scam, nothing fit and the conversations were tough to start.

Most tools focus on numbers, not people. And that disconnect is exactly why the hard conversations get avoided.

Sabal is my attempt to fix that: a secure workspace where families can work on finances together without sharing everything or needing power of attorney.

We just opened early access. If Sabal sounds like something that could help your family, I'd love to hear how you're managing things today and what would make it easier.

— Allen Sanford