Individual Insights, Joint Planning

You want to see fine-grain details, while your partner wants the 'big picture'. Sabal gives you both what you need without overwhelming anyone.

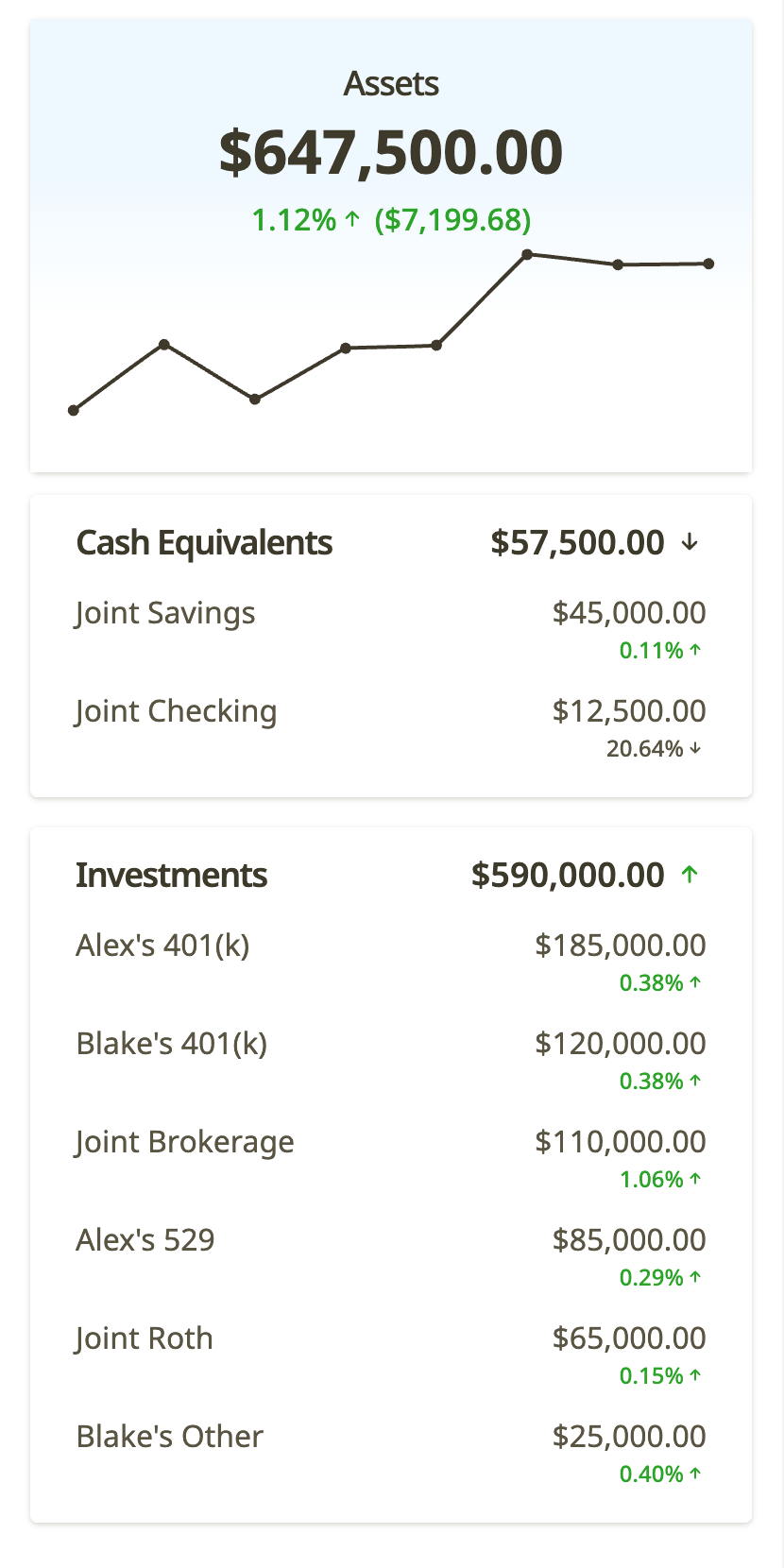

- See every transaction and holding details while your partner views spending summaries and account totals

- Generate detailed investment reports for yourself and simple progress updates for joint planning sessions

- Track individual investment performance alongside your combined retirement accounts

- All views stay current automatically - no manual updates or spreadsheets to maintain

Your Digital Kitchen Table

Financial conversations need more than account balances. Sabal brings together everything couples need when making big decisions.

- Store important documents - insurance policies, mortgage agreements, POAs - where you can both find them when needed

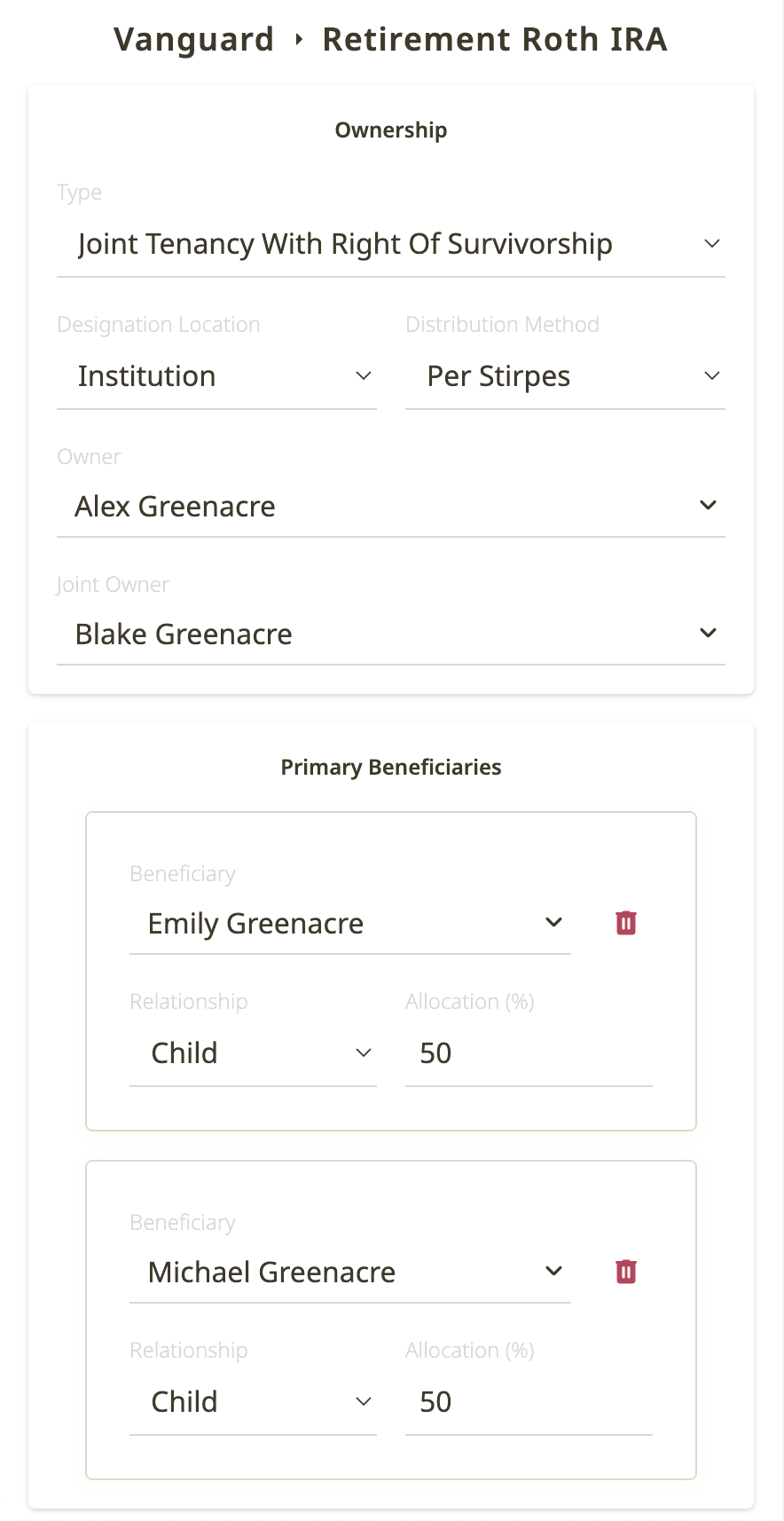

- Track beneficiaries and contingent beneficiaries across all accounts to stay aligned on your estate planning

- Generate custom reports to answer specific questions - combined emergency fund, individual retirement progress, or household investment exposure

- Keep your financial team contacts organized - advisors, attorneys, insurance agents - with notes on who handles what

From "Someday" to "Today"

Sabal's checklists and tools help you tackle the decisions you've been meaning to discuss

- Review and align beneficiaries across all accounts - finally check that box you've been avoiding

- Use our Financial Check-In checklist to make reviewing finances a habit

- Create custom checklists to bring your current to-do list into Sabal

- Keep tabs on your emergency fund across institutions with a custom report

Partnership, Not Pressure

Early members get a 30-day free trial (no credit card required) and early-access pricing, plus guided onboarding to help you get the most out of Sabal.

Monthly

Yearly

$59.99

per year